The original Fang Sheng’s lecture on tracing is included in the topic # Tracing Talk 88# Caste System 2# India 2# Aryan 2.

Follow the trail and tell.

Give life another possibility with culture.

Author: Fang Sheng

Pictures/Typesetting/Proofreading: Tracing Xiaobian

The full text is about 3200 words, which takes about 10 minutes.

01

What is the caste system?

First of all, we have to be clear about a question: Why is the caste system called "caste"?

Because it is not the same as the simple racial hierarchy, it is not to say that you are black and you are low in rank, but to frame you in a specific social class with your bloodline.

Moreover, surnames are bound to families. Just look at your surnames and you will know at which level your family should be. In this way, as long as you limit each family to intermarry within the same caste, you can be framed and it is almost impossible to cross classes, thus stabilizing people at all levels of the whole society.

India’s caste system was first invented by foreign Aryans. After they conquered northern India, they invented such a hierarchy in order to facilitate the rule of the indigenous Dravida people. It was generally called Varna, which was the predecessor of the later caste system, and the religion used to explain this system was Hinduism.

▲ Indian Aryans (left) Dravidian (right) The picture originated from the Internet.

The core of the Varna system is "clean" and "unclean", clean or not.

For example, whether you are a vegetarian, whether you are exposed to corpses, blood, etc., some Aryan classics also give a clean contempt chain for many things. For example, gold is cleaner than silver, silver is cleaner than bronze, bronze is cleaner than brass, and brass is cleaner than pottery.

For another example, there are 12 kinds of unclean things on people, not to mention shit, even spitting is unclean.

▲ People who wash on the banks of the Ganges River: Hinduism believes that water can wash unclean and evil, and the Ganges River has the best washing effect, so Indians often bathe or wipe their bodies on both sides of the Ganges River. Image from the network

If a person touches something unclean, then he is unclean. However, people’s impurity is temporary and permanent. I’ve got something dirty on my body, and it’s unclean. Wash it, and of course it’s clean again.

However, if you often touch unclean things, people’s impurity becomes permanent.

For example, those who specialize in disposing of corpses and burying the dead, and those who often wash clothes with blood, if you keep doing this kind of work, you will be unclean, and you will have to be isolated from others, so as not to meet others and get them dirty.

They can’t even cover the shadows of other castes. Cover them and say that you have polluted others’ shadows. Therefore, such people are called "untouchables". They can’t touch them. They are too dirty.

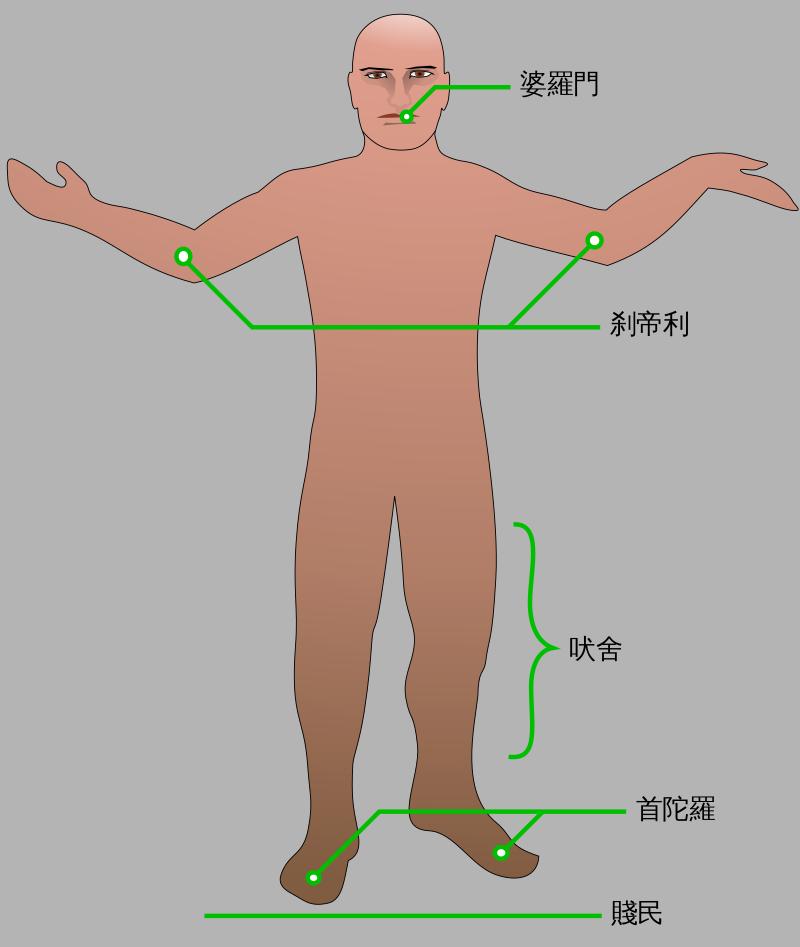

▲ According to the Varna scale painted in the Song of the Rigveda Primitive Man, Brahman is the mouth of Primitive Man, Khshatriya is the arms of Primitive Man, Vedas are the thighs of Primitive Man, and sudra is the feet of Primitive Man. As for untouchables, they are excluded from the body of primitive people. Image from the network

This is the lowest level in the whole caste system, and it is called "Da Park Jung Su", which means "Dalit". Dalits are basically conquered Indian aborigines, mainly the Dravidians.

02

Control Indian society

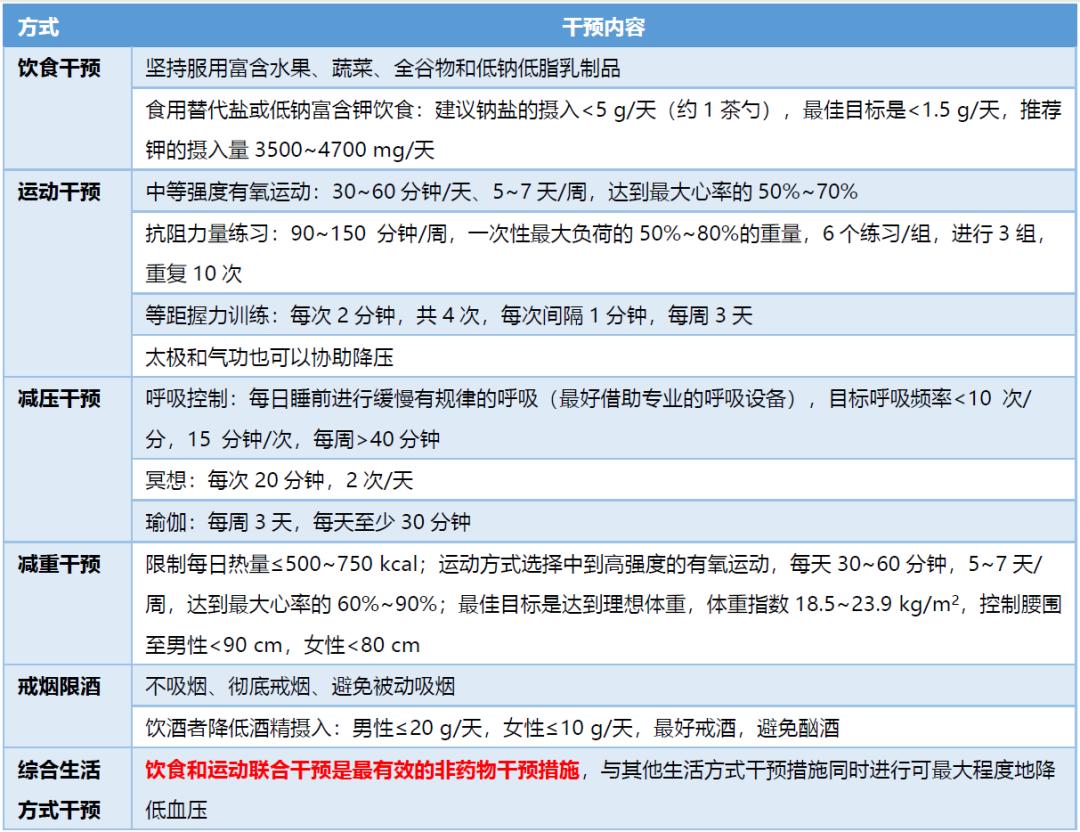

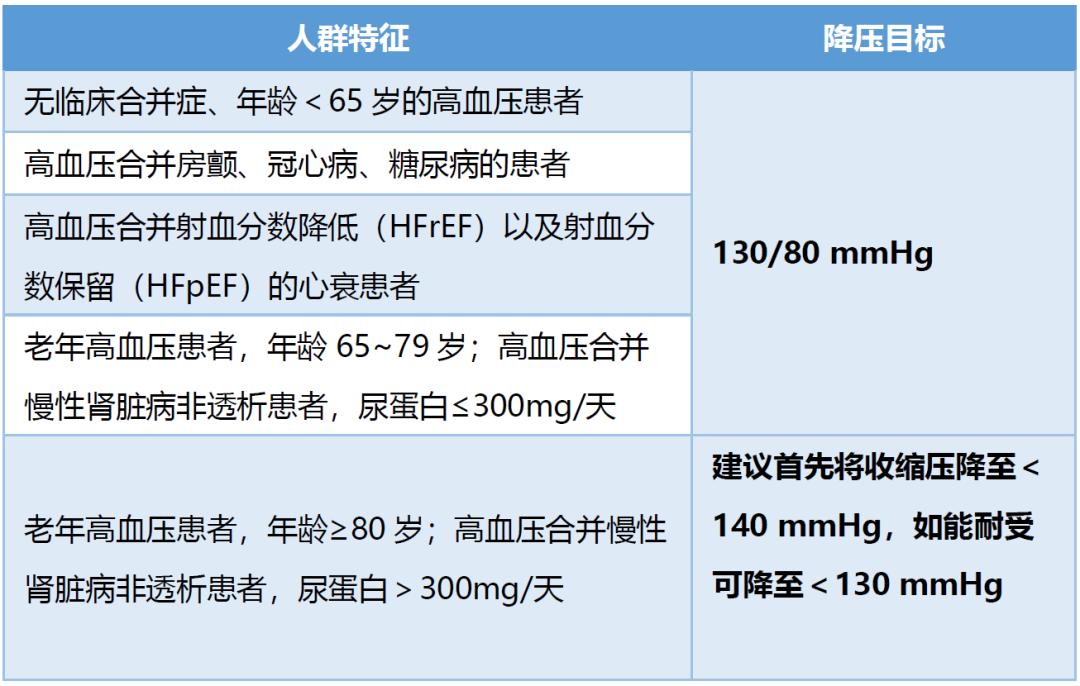

Except for these untouchables who are always unclean, the rest are divided into four castes, which are called Varna. From low to high, they are: sudra, Vishnu, Khrushchev, Brahman.

Let’s look at the lowest level, Varna: sudra.

Hinduism says that sudra people changed from the feet of primitive people. The concept of primitive people is very complicated. To put it simply, it is the life body that started the universe in Aryan mythology, and later turned into everything in the world, which is somewhat similar to Pangu in China mythology.

Sudra is mainly a Dalopita, and this class is a slave, similar to the domestic slaves in ancient China, mainly serving people.

▲ The Dalai Lama map originated from the Internet.

Varna, one level higher than sudra, is a monastery, which was changed from primitive legs. Aryan classics stipulate that the Vedas can farm, graze and do business. To put it bluntly, they are ordinary people who can earn a living by their own physical or mental labor. The next level is the Khrushchev, which is the arm of the primitive man.

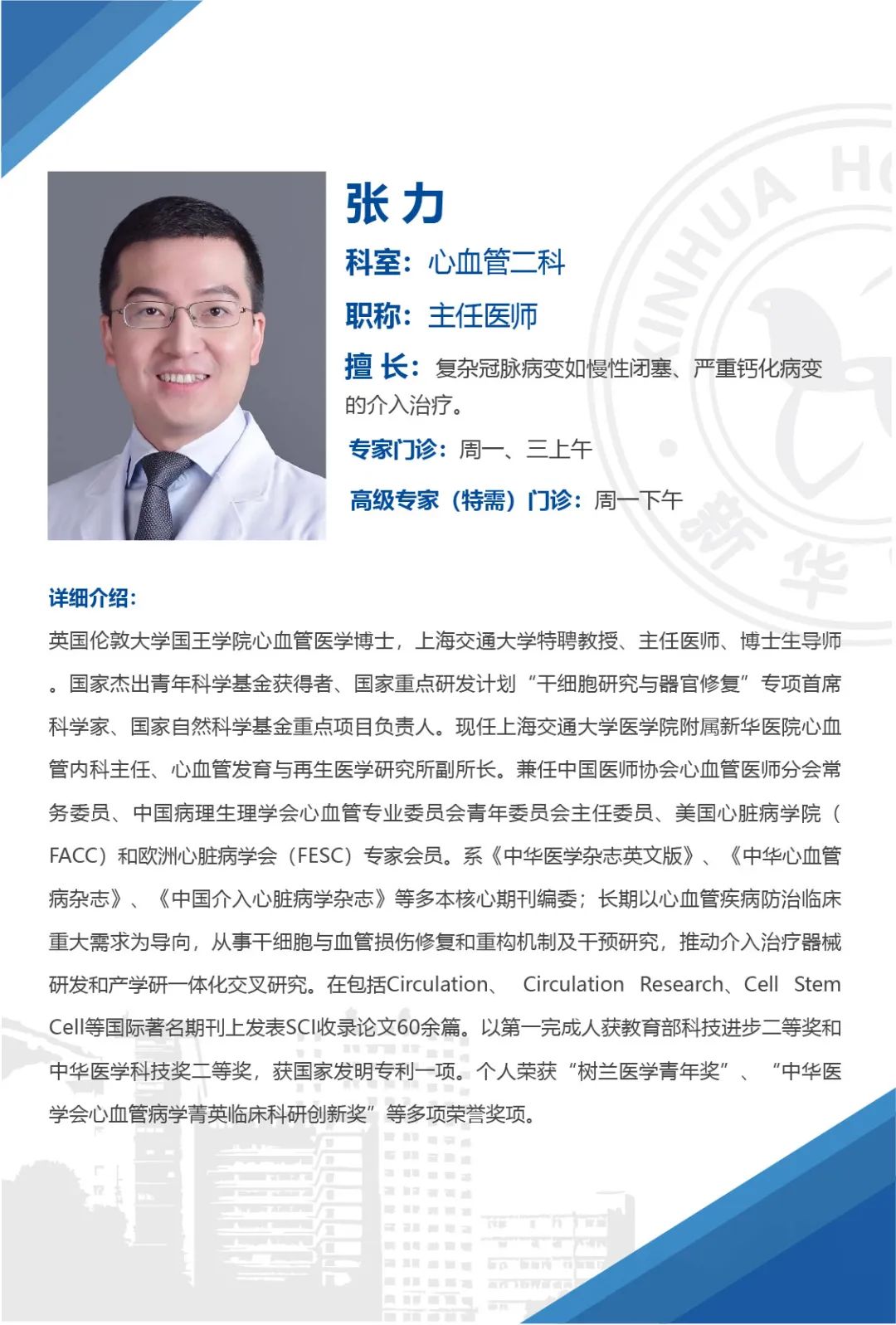

Khrushchev is a warrior class with political and military power, but no religious power. Religious power is in the highest level of Varna, that is, in the hands of Brahmins. According to Aryan classics, Brahman is the mouth of primitive people, that is, the spokesman of God.

Brahman and Khrushchev, basically Aryans, control the whole country in religious and secular aspects respectively.

Brahman, Khrushchev and Visha, men of these three castes, when they are about 10 years old, should be presided over by Brahman, which is similar to adult ceremony.

▲ The caste system map originated from the network.

Born from the womb, it was only a physical birth. After this ritual, it was a spiritual birth. This is a true Hindu who can participate in various religious ceremonies. Body+spirit, born twice, so these three castes are also called "regeneration clan".

Sudra and Dalits can’t participate in the ritual, so these people are only born physically, not spiritually, which is called "Lifetime Family". According to the teachings of Hinduism, because the whole generation has no spirit, it is no different from animals.

So you see, this system is completely for controlling people’s use. All people are born with their own position in society, and they have been brainwashed by this theory since childhood, which is convinced.

As a result, the whole society has a clear division of labor, the political power is stable, and Aryans, as rulers, have the final say in how the system determines them, so they have to come to things related to religion and sacrifice; As the conquered people, the Dravidians have to do all the dirty work, including social production, farming and grazing.

▲ Monks who play music that serves the gods-Brahmins (upper left) warriors with weapons are also feudal lords-Khrushchev (upper right) businessmen who calculate money with scales are also farmers-Vedas (lower left) have no symbols at the bottom slave-sudra (lower right) The picture originated from the network.

When the Aryans first came up with this Varna system, they didn’t actually involve oppression or slavery. Their main purpose was to make everyone have a fixed social division of labor, such as cleaning toilets and cleaning bodies. If the Aryans didn’t want to do it, they had to be done by the Dravidians, so they were the conquered.

For another example, Brahmins have the highest rank, and they control religion. However, the warrior class represented by the king is the second-class Khrushchev. If you think about it with your toes, you can know that whoever has the army has the final say, and it is actually Khrushchev who holds the real power. Therefore, it does not mean that Brahmins will oppress Khrushchev and Khrushchev will oppress lower-level monasteries.

Discrimination between different classes actually developed later.

03

Residual poison has caused harm to this day.

As we said before, the history of India is almost a history of foreign conquest. India is constantly invaded and conquered by foreign nationalities. Every time a foreign invasion, it will bring new culture and impact the caste system.

So how can this set of things continue to this day?

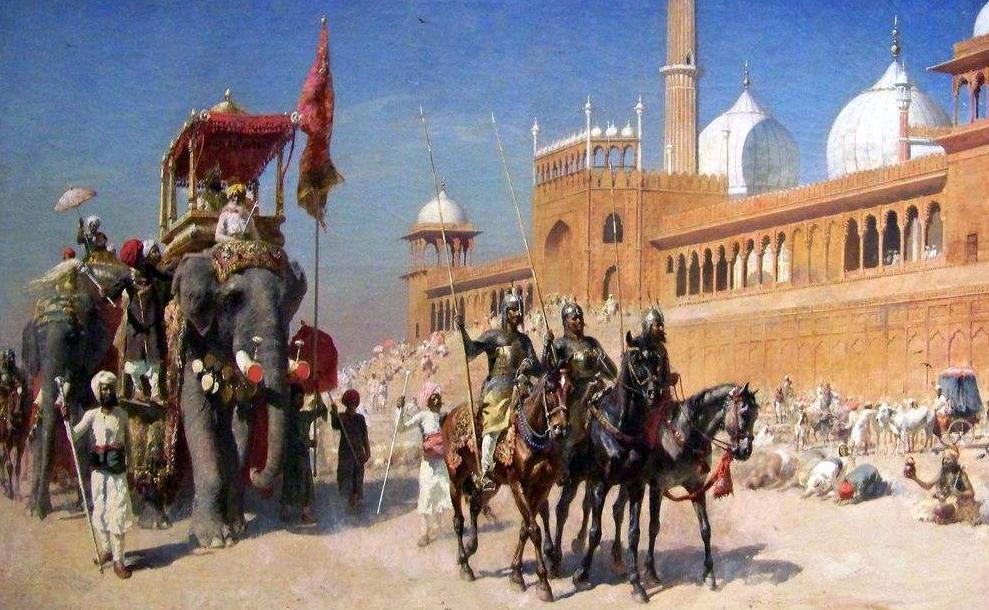

In fact, the reason is very simple. No matter who conquered India, when you look at this system of Aryans, everyone applauds, which is conducive to rule. Therefore, whoever comes here is careless, and everything remains the same. If any conqueror wants to change the caste system, it must be a bad thing.

▲ Mughal empire map originated from the network.

For example, in the 16th century, Mongolians established the Mughal Empire in northern India. These Mongolians were culturally Islamized, but after they conquered India, they did not forcibly promote Islam, but used Hinduism to rule India, with good results.

After several generations of emperors, the emperor’s brain was pumping, and he insisted on pushing Islam all over the country, which led to boiling public grievances. sudra and Dalits have been pigs and dogs for thousands of years, and you Mongolians have to make people own things, which hurts the heavens. Therefore, resistance came one after another everywhere, which eventually led to the collapse of the empire and India’s division again.

After India became independent from Britain in 1947, as a country determined to modernize, India will certainly abolish the caste system.

▲ Indian Mahatma who is persuading the Indian people to give up the caste system-Gandhi originated from the Internet.

Although the caste system has been abolished in law, it is still deeply rooted in the minds of ordinary people. In daily life, the influence of the caste system still exists, such as finding a job and renting a house, and there will be caste discrimination to some extent.

Marriage is even more so. According to tradition, people of the same caste can marry, but men of high caste can also marry women of low caste. This is called marriage, and the children born are still of high caste. However, if a high-caste woman marries a low-caste man, it is called reverse marriage, and the children they gave birth to are the lowest untouchables.

However, the population of Brahman and Khrushchev, the highest caste, accounts for a small proportion, which leads to a situation. Some high-caste women can’t find men, and their families can only attract men of the same caste through rich dowry, while many low-caste women also want to climb high-caste men, and their families will also increase the dowry. As a result, no matter which caste, women have become the burden of the family. Whether before or after marriage, their family status is very low, and their wives are almost husbands.

▲ Indian wedding map originated from the Internet.

According to the survey statistics of some international organizations, a quarter of Indian men admit that they have committed sexual violence, and a fifth of Indian men admit that they have done something similar to rape. Moreover, more than half of Indian men believe that women should fight and not fight is dishonest.

Therefore, there are a lot of rape cases that have exploded in India in recent years, and I don’t know how many have not. These men who commit crimes basically don’t treat women as human beings. The root causes can be traced back to the caste system.

Then why can’t this caste system be eradicated?

The main reason is that India has never experienced a thorough social revolution. If nothing else, look at China. Thousands of years of feudal ethics, so many bad habits, the Revolution of 1911, and the May 4th Movement have washed away the things in the old society.

India, on the other hand, has never been. The conquerors of foreign invasions have to rule the local people with the help of the caste system. They hope that the caste system will continue all the time. The founding of India is not a result of violent revolution to overthrow the British colonists, but a result of compromise. The original political forces and various cultures have basically been preserved. As the core content of Hinduism, the caste system is even more difficult to be completely eradicated.

(End)