Some bus lines operate until 3 am! On New Year’s Eve, the travel guide of "burning your head" is coming.

Passengers going to Lingyin Temple, yongfu temple and Taoguang Temple

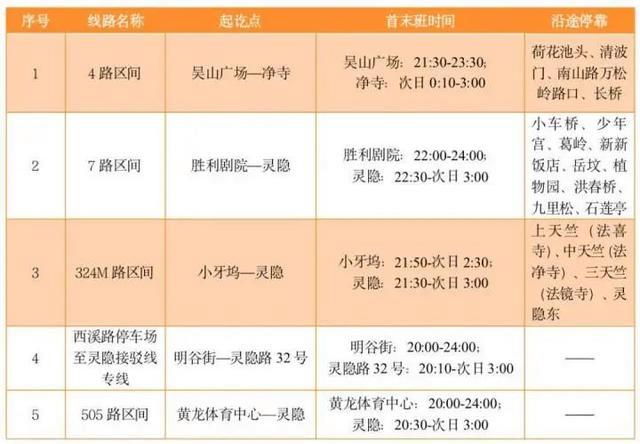

You can take No.7, 324M and No.505 to Lingyin Temple, yongfu temple and Taoguang Temple. On New Year’s Eve, the section line from Victory Theatre to Lingyin will be added on Route 7. The 324M road will increase the interval line from Lingyin to Xiaoyawu; No.505 Road will open the interval line from Huanglong Sports Center to Lingyin.

Passengers bound for Jingci Temple

You can take the No.4 bus to Jingci Temple. On New Year’s Eve, Bus No.4 will open a section line from Wu Shan Square to Jingci Temple.

Passengers going to Shangtianzhu, Zhongtianzhu and Santianzhu

You can take busno. 324M to Shangtianzhu, Zhongtianzhu and Santianzhu. On the night of New Year’s Eve, the 324M Road will be opened from Lingyin to Xiaoyawu, passing through the interval line of Tianzhu Third Temple.

According to the traffic management measures issued by the traffic police department during the New Year’s Eve blessing activities in Buddhist places in West Lake Scenic Area, motor vehicles are prohibited from entering Lingyin area (except buses, work vehicles, units along the line and residents’ vehicles) from 20: 00 pm on New Year’s Eve to the end of the New Year blessing activities. Depending on the situation, the Lingyin route is one-way from east to west, and the Lingyin branch is one-way from west to east.

Therefore, we recommend that on New Year’s Eve, citizens who choose to drive by car or take a taxi or network car can go to No.608 Xixi Road and Xiaoyawu Bus Station to realize the "car for car".

On New Year’s Eve, No.608 Xixi Road arranged the "Lingyin fastest connection line", and the connection service time was from 20: 00 to 24: 00; Citizen passengers can also transfer to the 324M section at Xiaoyawu bus stop to go to Lingyin Scenic Area.

On New Year’s Eve, we also list the specific information of the bus supporting lines for the Spring Festival blessing activities for everyone:

Source: Hangzhou Bus