Economic topics are hot topics in the two sessions, which one can you not pay attention to? !

The press conferences of the National People’s Congress and the National People’s Congress contained a lot of information about tax reduction and fee reduction, consumption promotion, private enterprise financing and pension pressure & HELIP; … A series of economic hot topics that everyone is concerned about have responses here. Xiaobian walks into the press conference with you. Ask and answer quickly ↓ ↓ ↓

Economic trend

How to predict the economic trend this year?

He Lifeng, Director of the National Development and Reform Commission: The national economic trend has progressed steadily this year.

The current economic situation is generally stable, stable and changeable, but the overall trend is still steady and progressive.

On the stable side: the main economic indicators are stable. Last year, the GDP increased by about 1.4 trillion US dollars, ranking first among the top five economies in the world. Stable employment, with 13.61 million new jobs in cities and towns throughout the year; 13.86 million people were steadily lifted out of poverty; In addition, there are stable exchange rates and stable foreign exchange reserves.

Progress: the reform of the party and state institutions is unprecedented, but it is progressing smoothly; In the ranking of the World Bank’s business environment, China has risen from 78th to 46th, up 32nd place a year, and may make even greater progress this year.

What is the "main course" in the "big meal" of tax reduction?

Minister of Finance Liu Kun: Deepening VAT reform is the core content of tax reduction and fee reduction this year.

Reducing taxes and fees is the top priority of this year’s active fiscal policy. Deepening the reform of value-added tax is the core content of tax reduction and fee reduction this year, which is what you call the "main course".

We will reduce the current tax rate of 16% for enterprises such as manufacturing to 13%, and the current tax rate of 10% for industries such as transportation and construction to 9% to ensure that the tax burden of major industries is significantly reduced.

Adjusting the value-added tax rate to 13%, 9% and 6% will be conducive to continuing to promote the three-level and two-level VAT rate.

Has consumption been downgraded?

Ning Ji Zhe, Deputy Director of the National Development and Reform Commission: The consumption structure is upgrading

Compared with the previous year, the growth rate of total retail sales of social consumer goods did slow down slightly last year, but it still increased by 9%, which is not low.

The consumption structure has been upgraded, and the proportion of food expenditure reflecting the upgrading of consumption structure in the total consumption expenditure has dropped below 30% the year before last, and it was 28.4% last year, reaching the level of higher-income countries.

The fundamentals of China’s sustained consumption expansion have not changed.

This year, we will promote the scrapping and updating of old cars, continue to implement the purchase policy of new energy vehicles, and accelerate the commercial deployment of "5G".

What are the new measures in promoting consumption this year?

Zhong Shan, Minister of Commerce: Solving the Problems of Difficult and Expensive Hiring Nannies in Large and Medium-sized Cities

This year, the Ministry of Commerce should pay attention to three things in promoting consumption: First, promote urban consumption and promote consumption upgrading. Transform and upgrade a number of pedestrian streets and optimize the layout of convenience stores. The second is to expand rural consumption and promote "agricultural products entering the city and industrial products going to the countryside". The third is to develop service consumption and optimize service supply.

Looking at it now, the aged care service is an obvious shortcoming. Another shortcoming is the domestic service in the city. Especially in large and medium-sized cities, it is difficult and expensive to hire a nanny. It is very difficult to hire a good nanny and a satisfactory nanny. In the next step, we will continue to do a good job in this area.

How to boost the confidence of private enterprises?

Liu Shijin, member of Chinese People’s Political Consultative Conference: Private enterprises should have equal development conditions and a level playing field.

We should have confidence in the major policy of supporting the development of private enterprises. The major policy of supporting the development of the private economy cannot be changed, nor should it be changed, nor can it be changed.

The development of private economy depends on policies and the rule of law. I have also heard from some private enterprises that what we are asking for is actually not any extra preferential treatment or special care, let alone a partial meal. What we want is conditions for equal development and an environment for fair competition.

It is necessary to effectively solve the hidden rules of formal equality and actual inequality. For example, this is true in terms of loans and deleveraging.

Opening to the outside world should also be open to the inside, for example, to private enterprises. An industry, as long as capable enterprises in Chinese and China are allowed to do it, few industries say that enterprises in China are not competitive.

How does this year’s fiscal and taxation policy support the development of small and medium-sized enterprises?

Liu Wei, Vice Minister of Finance: All enterprises with total assets of less than 50 million have the conditions to be recognized as small and meager profit enterprises.

It is a very big policy to adjust the identification standard of small and low-profit enterprises. Those with total assets of less than 50 million have the conditions to be recognized as small and meager profit enterprises; The number of people is determined to be less than 300; There is also taxable income, which used to be less than 1 million, but now it is all mentioned below 3 million.

After the adjustment, the key is to increase the preferential income tax. There is also the threshold for raising small-scale taxpayers of value-added tax, which was originally 30 thousand, and now it is mentioned as 100 thousand.

We also stipulate that local governments can halve the current six local taxes. Further expanding the scope of application of preferential tax policies for start-up technology-based enterprises can expand as much as possible.

How to solve the problem of "difficult and expensive financing" for small and micro enterprises?

Pan Gongsheng, deputy governor of the People’s Bank of China and director of the State Administration of Foreign Exchange: Adhere to precise support and prevent sudden lending.

In the process of supporting small and micro enterprises and private enterprises in financing, we should pay attention to market rules, adhere to accurate support, and select those private enterprises that are in line with the national industrial development direction, whose main business is relatively concentrated in the real economy, advanced technology, products have a market, and temporarily encounter difficulties to give key support, prevent blind support and surprise lending, and enhance the ability to prevent and control future financial risks.

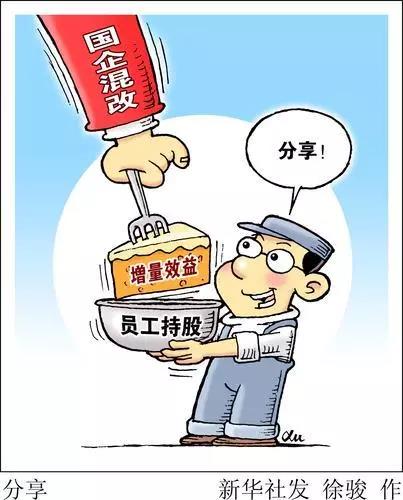

How does social capital participate in the mixed reform of state-owned enterprises?

Lian Weiliang, deputy director of the National Development and Reform Commission: Social capital can hold state-owned enterprises in the field of complete competition

Open the door to entry: mix reform in key areas and encourage social capital to enter. Mixed reform in the field of perfect competition, allowing social capital to hold shares.

Improve the quality of reform: promoting all mixed reform enterprises can really build a perfect corporate governance structure.

Protection of existing rights and interests: protect the property rights and legitimate rights and interests of all shareholders equally, and truly ensure that all shareholders speak according to their capital and exercise their rights according to their shares.

The channel of smooth retreat: it is necessary to allow all kinds of social capital to enter in an orderly manner, but also to withdraw according to law.

What is the current development of the credit system?

Chen Yulu, deputy governor of China People’s Bank: Mother-in-law’s choice of son-in-law depends on the credit record.

The construction of China’s credit system is a two-wheel drive of "government+market". At present, there are 125 enterprise credit reporting agencies and 97 credit rating agencies in the market, and more than 80% of these institutions are invested by private capital. Baixing Credit Information is the first market-oriented personal credit information agency in China. At present, Baixing Credit Information has signed up to access the credit information of more than 600 institutions, and officially launched three credit information service products such as personal credit report in January this year.

Credit information service is now entering the social field more and more. For example, the daughter is looking for a boyfriend, and the mother-in-law asks her son-in-law to bring the credit information records of the People’s Bank of China. Now, the first two inquiries of the People’s Bank of China’s credit records are free, and the online inquiry of the simplified records is also free. You can try it.

How to crack down on dishonesty such as counterfeiting, academic misconduct, and Lao Lai?

Lian Weiliang, Deputy Director of the National Development and Reform Commission: Increase the intensity of joint punishment for dishonesty

An important reason for the high incidence of dishonesty is that the cost of dishonesty is too low. The next step will highlight "three efforts":

First, efforts should be made to increase the joint punishment for dishonesty, so that relevant market players can’t, can’t and don’t want to break their promises. Second, efforts should be made to expand the joint incentive of trustworthiness, and this year we will focus on improving the system and mechanism of "benefiting trustworthy people everywhere". Third, focus on building a new supervision mechanism with credit as the core, and increase the proportion and frequency of spot checks on market entities with high risk of dishonesty.

How to avoid the problem of difficult pension payment in some provinces last year?

Minister of Finance Liu Kun: It can ensure that pensions are paid in full and on time.

At present, the national social insurance fund as a whole has more income than expenditure, and the scale of accumulated balance still keeps growing.

There are indeed some provinces in China where the pressure of fund balance is relatively high. Last year, the central adjustment system of the basic old-age insurance fund for enterprise employees was established, which alleviated the problem of uneven burden of funds in various places to some extent.

This year, the adjustment will be further strengthened, and the adjustment ratio will be raised to 3.5%. It is estimated that the size of the central adjustment fund will reach about 600 billion yuan in the whole year, further alleviating the pressure on the income and expenditure of funds in individual provinces.

Pension is the "life-saving money" entrusted by ordinary people to the state management. Judging from the arrangement of endowment insurance funds this year, all provinces can achieve a balance.