China color TV entered the second half, who will be the big winner?

With the overall decline of China’s color TV market, the decline in quantity has become the most frequently mentioned keyword in the first half of the year-recently, GfK Zhongyikang released a report that in the first half of 2022, the retail volume of domestic color TV market was 16.36 million units, down 8.5% year-on-year; Retail sales reached 55.1 billion yuan, down 11.5% year-on-year.

Finding certainty in uncertainty and building stability in instability have almost become the belief of the whole industry. In view of the polarization of the color TV market in the first half of the year, especially the gradual increase of high-end quality products, the advantages of high-end brands represented by Sony have been highlighted, and the industry trend under adversity has been grasped.

As the absolute king of "high-end big screen", Sony TV is also the industry vane, and many TV brands also benchmark their flagship products with Sony TV as a representative of the brand’s high-end jump.

With the image of "Sony of technology" deeply rooted in people’s hearts, consumers voting with their feet is the best proof. In the first wave of pre-sale of 618 this year, Sony won the first place in the pre-sale amount of self-operated flat-panel TVs in JD.COM; In CHNBrand’s China Satisfaction Index in 2021, Sony became the top color TV brand satisfaction index.

In order to let consumers experience the charm of Sony TV at close range, on August 17th, Sony held a new TV experience meeting in its Hangzhou Direct Store. Among them are Sony’s first domestic TV A95K equipped with QD-OLED and Mini LED TV X95EK. These new products are equipped with exclusive XR chips and new smart cameras, which have attracted much attention.

Sony is almost paranoid in the pursuit of audio-visual experience. From this year’s new products, it can also be seen that Sony has improved the localized application design in order to get close to the living habits of Chinese people and create a Sony-style smart living room.

In China’s color TV market, where foreign TV brands have almost disappeared, Sony TV has not only gained a firm foothold, but also gained new vitality under the background that both the consumer and the supplier are facing challenges at the same time. How on earth did this happen?

"In recent years, the whole macro-economy has all kinds of uncertainties. The China market has changed too fast, and the market trend is not determined by a certain sub-industry or a certain manufacturer." At the Hangzhou New TV Experience Meeting, Xie Biao, President of Sony (China) Consumer Electronics Business Headquarters, explained to 36Kr the particularity of the China market and introduced the process of Sony’s leaps and bounds.

Xie Biao joined Sony Corporation at the end of 1991. Since 2013, he has been the president of Sony (China) Consumer Electronics Business Department, responsible for all categories of consumer electronics business in Sony China. To some extent, Xie Biao witnessed and promoted the development of Sony’s consumer electronics products (civilian consumer goods) in China market, and was also one of the main witnesses of the development of China’s household appliances industry, especially the color TV industry.

According to his experience, people’s demand for color TV sets is mainly characterized by "building a new family or upgrading". Among them, building a new family is mainly affected by the demographic dividend and the environment, and the updating iteration is mainly affected by the fixed service life of TV products and technological innovation.

From 2005 to 2010, the whole industry changed from CRT TV to flat-panel TV. Since then, there seems to be no explosive TV technology revolution.Around 2016, China TV industry officially entered the stock stage. The general view in the industry is that in order to promote consumers to quickly iterate over TV at home, it is necessary to gain insight and always grasp their preferences.

"We found that all consumers who decided to change their TVs chose better and bigger TV products with specific needs, such as the rapidly developing OLED market." Xie Biao introduced that Sony TV, as an advocate of "high-end big screen", this strategic deployment can be traced back to 2014, which has been 8 years since.

In 2014, Sony locked in the direction of focusing on high-end and big screen in China TV market. In 2016, Sony took the lead in introducing the 100-inch Z9D series 4K HDR TV.

In 2017, Xie Biao defined the development direction of Sony TV in China market, formally established the macro strategy of "high-end big screen", focused on the high-end big screen market, focused on high-quality people, and passed on the core advantages of Sony TV in four aspects: image quality, sound quality, design and application to the target people.

In the industry, more brands have also seen this trend. Samsung and TCL have successively launched 98-inch large-screen TVs.But in the field of "high-end big screen", Sony is the real wind maker.

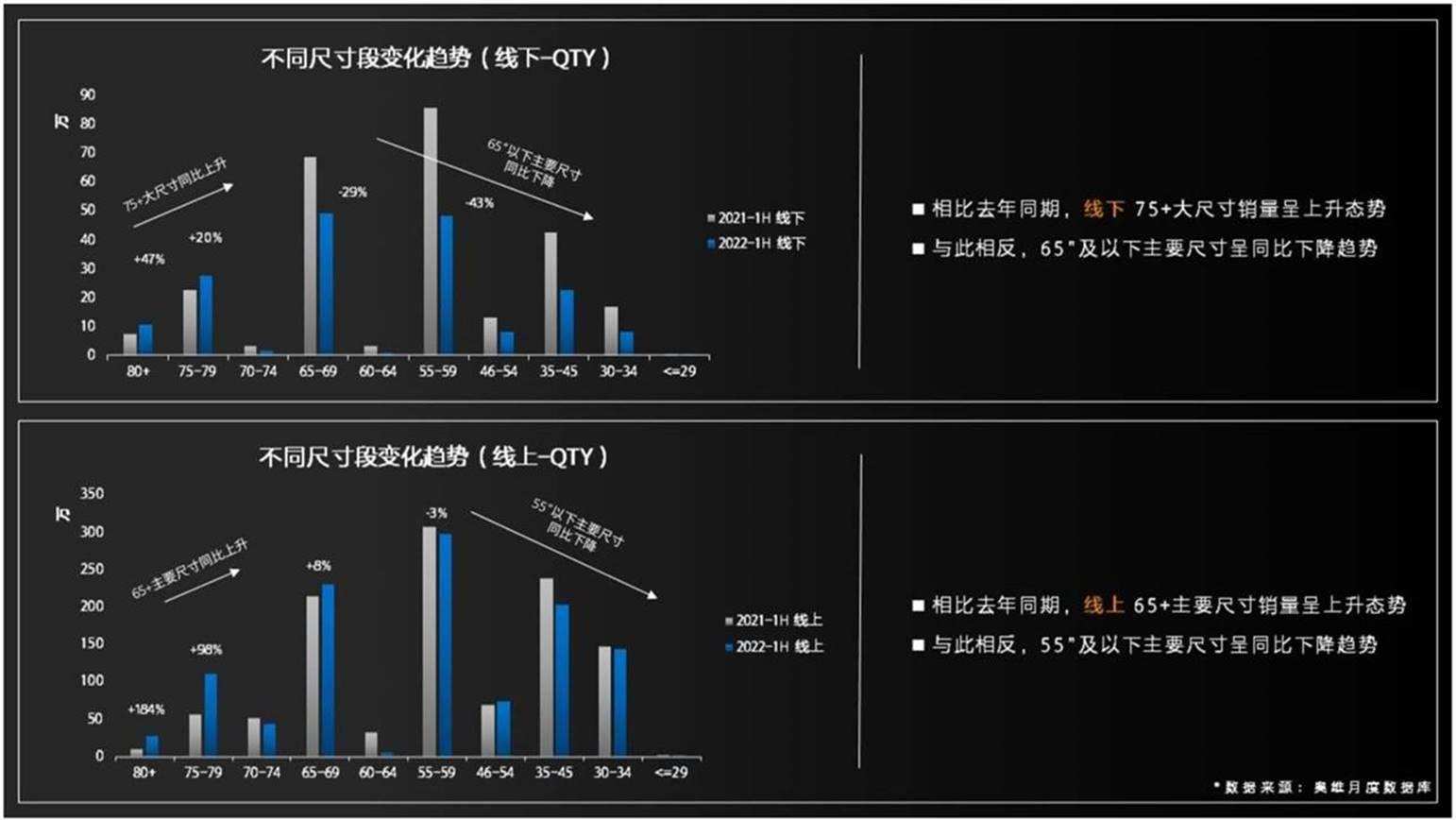

Nowadays, industry data verifies the accuracy of the "high-end big screen" strategy. Although the market is relatively saturated, the data of Aowei Cloud Network shows that from January to June 2022, the sales of TV sets of 75 inches and above both online and offline have risen sharply. It can be seen that the trend of users upgrading from small screen to big screen becomes more and more obvious.

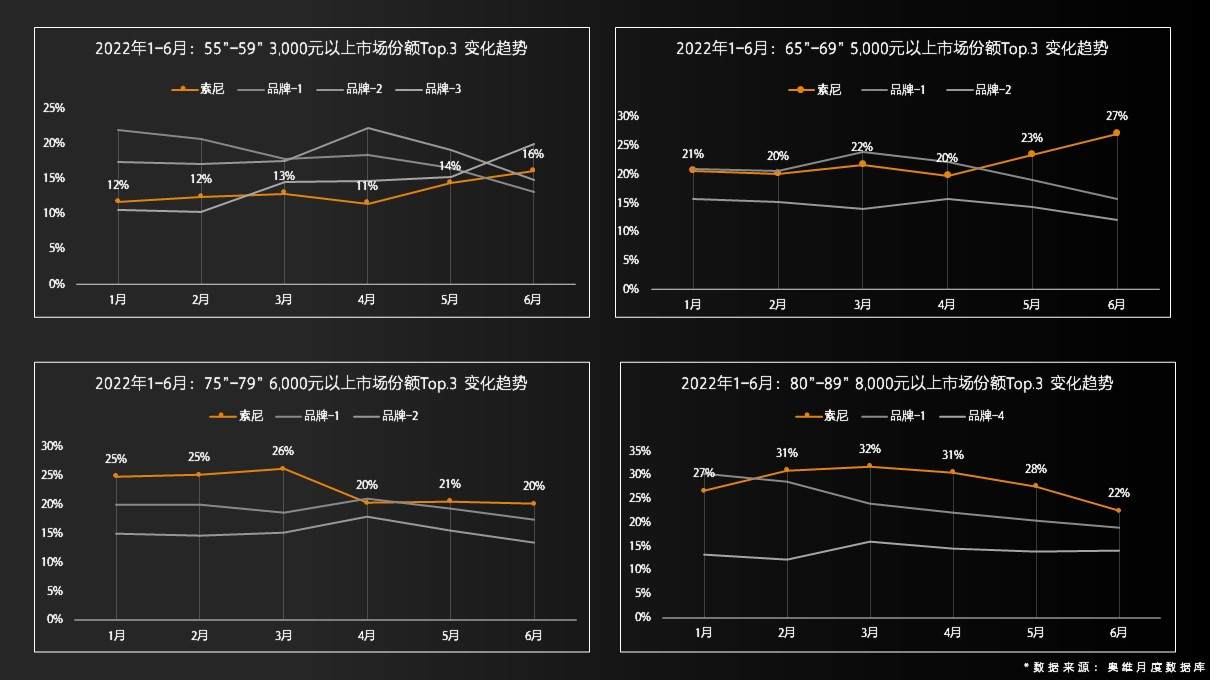

Among them, Sony TV has always maintained a high market share in the ultra-large screen TV market over 65 inches, especially 80-89 inches, and the price is more than 8,000 yuan. Behind its remarkable record, it is the victory of its products and China’s market strategy.

There are not a few companies selling big-screen TVs in the industry, and Sony has truly led the trend of high-end big screens in the industry, thanks to its deep cultivation of segmented people.

"In 2016, the total color TV market in China exceeded 50 million units, and the popularization of color TV sets nationwide was basically completed. Once popularization is completed and the quality of life is further improved, the next consumption trend is diversification of demand. Pursuing cost performance is no longer the only consumption concept, and price is not the only influencing factor. " Xie Biao told 36Kr.

With the entry of China market into the post-epidemic era and the rise of residential economy, Sony’s investment in subdividing the track has achieved remarkable results.

During June 18th, Sony X90K and X91K series game TVs attracted much attention. High-frame games presented coherent and smooth pictures and sensitive operation feedback, and the immersive game experience made them the purchase choice of host players.

As we all know, Sony is one of the major game manufacturers in the world and has a deep understanding of the various needs of gamers. Based on this, Sony can better meet the various needs of the game crowd and improve the production and technical level of TV products.

Through Xie Biao’s introduction, Sony is the first brand in China to open a complete product line of game TV.. As early as 2020, before the advent of the next generation of game consoles, there were few game TV competitions in the industry at that time. Sony X9000H series added 4K120 Hz, HDMI2.1 and other functions that were very important to gamers. From the production of game content to the realization of game terminal experience, this fully demonstrates the advantages of Sony’s own ecosystem interconnection. Understand not only products, but also users.

While Sony performed well in the game TV track, Xie Biao did not forget to emphasize that "the core crowd of TV is still film lovers".Therefore, the best audio-visual experience is the cornerstone of the product. In addition to the game track, Sony is also involved in sports events, fitness and other sub-tracks.

In fact, Sony’s long-term insight into China’s domestic market is indispensable for its ability to accurately grasp the subdivided track in China market.

The emphasis on consumers in China is first reflected in Sony’s new BRAVIA camera this year. This camera was put forward by Sony China to the headquarters, and was finally adopted before it was formed, which included Sony China’s insight and understanding of consumers in China.

In addition to the conventional interactive experience, it also has an AI environment sensing adjustment Pro. This exclusive function can adjust the audio-visual effect more intelligently and intelligently according to the distance between people and TV, bringing consumers a more immersive and comfortable viewing and gaming experience. Sony, the king of audio and video, continues to put TV audio and video in the first place. As Xie Biao said, "TV, the most essential thing, is still used for watching and listening."

In addition, according to Xie Biao, the change in the details of Sony TV’s "remote control" is also advocated by Sony China.

"When consumers first reported that Sony’s remote control was inconvenient, we improved it and turned the digital buttons into the simplest’ up and down’ buttons. In fact, from a technical point of view, this is not difficult at all. Based on the continuous feedback from users, this year we optimized the design of the remote control again. "

According to him,Sony China is continuously advancing the localization process with the fastest speed.At the end of 2021, Sony even transferred the product planning department related to China market from Japan to Shanghai, which also showed Sony’s confidence in China market. "We are willing to seriously plan Sony products suitable for local needs for China consumers."

For the "IoT terminal" that is indispensable for intelligence, Sony hopes to build an open ecosystem. On the one hand, through the business advantages and accumulation of Sony Group’s existing "from lens to living room" whole industry chain, it creates Sony’s unique value for users. Because Sony’s products have the same technology in the field of audio and video.

On the other hand, Sony chooses to cooperate with local business partners, such as JD.COM Xiaojia and Tencent Xiaowei, to interconnect with different brands of hardware in a more open manner, which is more convenient for consumers to use. Starting from this year’s products and functions, we can continue to look forward to the follow-up achievements of Sony’s product planning department, which has moved to China.

With the growth of "digital native generation" consumers in China after 1995 and 00, Sony also pays more attention to cooperation with local social software such as Tencent.

In 2016, Sony TV took the lead in cooperating with tencent games. Immediately, the cooperation between Sony and Tencent involved many aspects such as content business and WeChat. Including in 2020, Sony and Tencent jointly developed the "Aurora Calibration Mode" to raise the content level of film and television streaming media to a higher standard and restore the creator’s intention from the sound and picture performance of TV.

In Xie Biao’s introduction, Sony is more willing to meet the social needs of young consumers. "We found that young people in China rely much more on social media than consumers in other countries. Sony also hopes to upgrade its product features based on the social behavior of young people in China. "

In terms of channels, Sony China also adopts different strategies for online and offline.

Because of the unique value of e-commerce, in 2009, Sony has directly cooperated with major e-commerce platforms, and attached great importance to the efficiency, customer coverage and penetration of e-commerce channel supply chain. According to Xie Biao, Sony can do scientific marketing based on various big data technologies, and at the same time feed back the supply chain and product design.

For offline, Sony mainly cares about two aspects: first, build a strong supply chain system to better spread products to major retail terminals; The second is direct contact with consumers through offline retail.

Therefore, Sony has been steadily promoting the construction of offline direct-operated stores for many years. Up to now, it has seven direct-operated "Sony Store" in Beijing, Shanghai, Guangzhou, Chengdu, Hangzhou and other cities, aiming at better communication and interaction with consumers and bringing consumers an excellent experience.

In Xie Biao’s view, the best way for a product to promote well and stand on the market is to let consumers experience the real machine directly. The real machine experience is also one of the most important values of offline channels. This value will not disappear for a long time and cannot be completely replaced online.

"And from the point of view of most consumers, if you want to buy a product of 10,000 yuan or 20,000 yuan, you can’t make a decision just by a photo, you will definitely study this product in depth, which is based on our research and insight into consumers."

For high-end products, it is obvious that after the actual experience, we can fully understand the feelings brought by every detail, which is not experienced through flat pictures and videos. The dual efforts of products and channels give consumers more opportunities to experience the high-end advantages of Sony TV at close range, thus making it easier for users to make decisions.

Looking back, Sony can be seen in every important node of TV development. Since entering China in 1978, more than 40 years have made Sony one of the brands that truly understand the TV market in China and develop healthily.

Based on consumer insight and Sony’s core competitiveness, that is, Sony’s exploration and deep cultivation in the field of TV technology, in recent years, Sony TV has fought its way out of the domestic TV market with innovative technology, whether it is the Z9D series, which was known as the "master of light control" at that time, or the new generation of "QD-OLED TV" series A95K.

"It is not difficult to do TV, and it is difficult to do TV well."In Xie Biao’s view, there are two reasons why Sony can always stay ahead in the industry: one is consumer insight, and the other is to always play its core competitiveness.In the 44 years of domestic development, Sony is one of the few brands whose TV business is still developing healthily and continuously from the beginning to now.

"We have always adhered to sustainable, long-term and healthy development, and we have never blindly followed the price." Xie Wei said.

In his view, after experiencing the stage of rapid development and popularization, the home appliance industry will enter the stage of upgrading diversified demand. At this time, the overall home appliance industry will show a state of decline. Sony, on the other hand, insists on its core competitiveness, restores the real scene, and completes the audio-visual experience.

No matter how the environment changes, Sony is always the "Sony of technology".

It is reported that Sony’s eighth Sony Store direct store in Wuhan will open in the near future, which is also evidence of Sony’s optimistic attitude towards the China market and its investment. Sony always believes that with the effective prevention and control of the epidemic and the orderly recovery of the national economy, the color TV market will also benefit.

According to GfK Zhongyikang’s preliminary forecast, the retail volume of the color TV market in 2023 will be positive year-on-year, with an orderly recovery.